Walk into any store, whether it’s a big-box retailer, your favorite boutique, or even an online shop, and you’ll notice that pricing rarely feels random. That’s because it isn’t. Behind almost every price tag is a carefully considered strategy designed to guide your choices and influence how much you’re willing to spend. This is the psychology of pricing at work.

Marketers and retailers know that the way a price looks, sounds, and compares to alternatives can dramatically shift consumer behavior. Understanding these strategies not only helps explain why you buy what you buy, but also empowers you to recognize when something is truly a bargain and when it’s just clever psychology.

Charm Pricing: The Power of the 9s

One of the oldest and most common tactics is “charm pricing.” You’ve seen it everywhere: $9.99 instead of $10, $19.95 instead of $20. While the difference is only a few cents, studies show consumers perceive the product as significantly cheaper. This happens because we read prices left to right, so the “9” at the beginning anchors our perception lower.

Even when we consciously know $9.99 is essentially $10, our brains still register the smaller number more favorably. That’s why charm pricing continues to dominate.

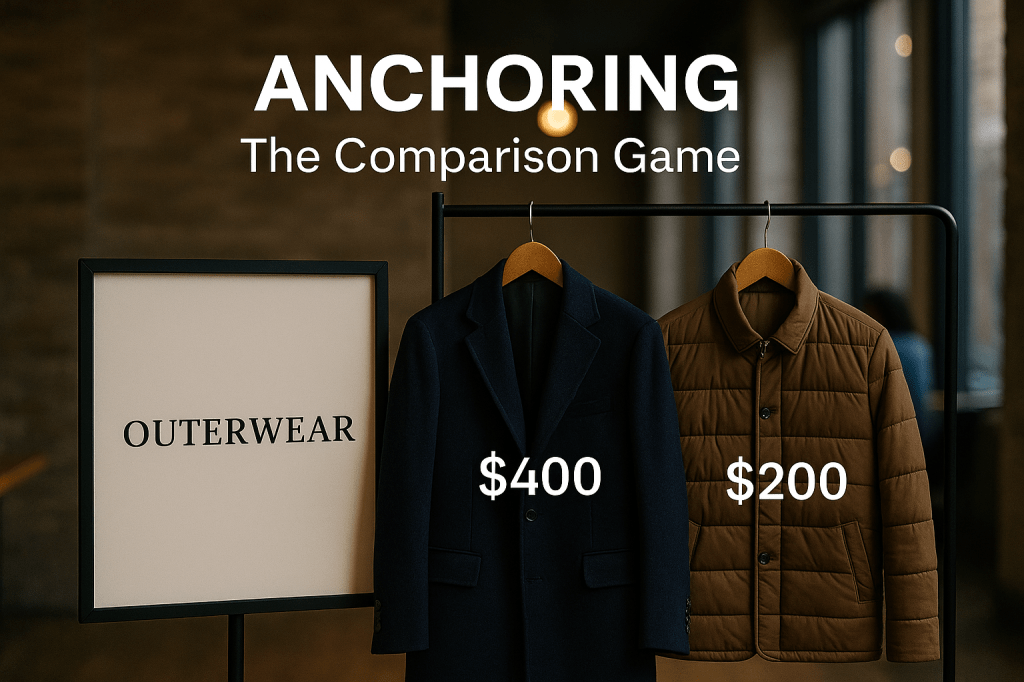

Anchoring: The Comparison Game

Anchoring occurs when a seller introduces a high-priced item to make other options look more reasonable. For instance, a clothing store might place a $400 coat next to a $200 coat. Few people will splurge on the $400 option, but the $200 one suddenly feels like a smart, balanced choice, even if it’s still more than you intended to spend.

Restaurants use the same strategy with menus: placing one very expensive entrée at the top makes mid-range dishes appear like better deals by comparison.

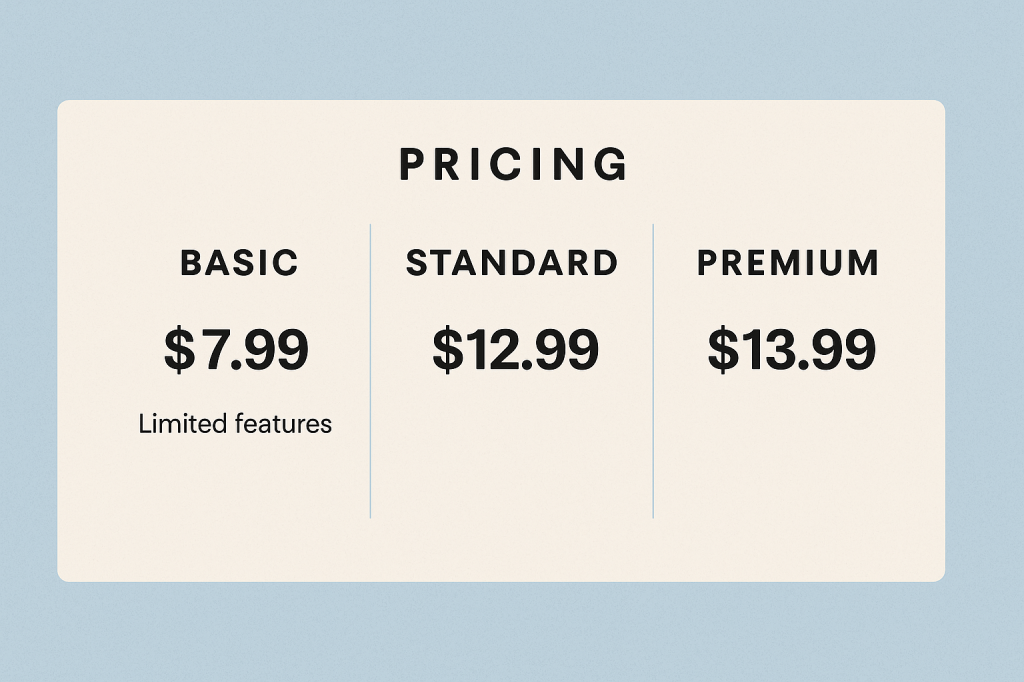

Decoy Pricing: Steering Without You Realizing

Sometimes companies create “decoy” options that exist primarily to push you toward a specific choice. For example, imagine a streaming service with three tiers:

- Basic: $7.99 (limited features)

- Standard: $12.99

- Premium: $13.99

Here, the small price gap between Standard and Premium makes Premium seem like the “obvious” best value, even though most people wouldn’t have chosen it without the decoy Standard option in the middle.

The Allure of “Free”

Nothing grabs attention quite like the word “free.” Free shipping, free gift with purchase, buy-one-get-one-free. These offers tap into our tendency to overvalue anything labeled as free, even if it isn’t actually the best deal. For example, people will often choose a “free” bonus product instead of a bigger discount on the main item, even if the discount would have saved them more money.

Scarcity and Urgency

“Only 2 left in stock.” “Sale ends at midnight.” These phrases play on scarcity and urgency, two powerful motivators. Psychologically, we have a fear of missing out (aka FOMO), and scarcity makes us assign higher value to limited items. While these tactics sometimes reflect real stock or deadlines, they’re often just strategies to push you to buy now instead of later.

How to Spot a Real Deal:

Look Beyond the Psychology

While these strategies are clever, they don’t always mean you’re saving money. To figure out whether you’re looking at a true bargain, you need to move past the surface-level tricks and evaluate the actual value.

1. Unit Price: Keep a Lookout For It

One of the simplest yet most effective strategies is to look at the unit price: the cost per ounce, per pound, per liter, or per item. Grocery stores often list the unit price on the shelf tag, though it’s easy to overlook.

For example:

- Box A of cereal costs $4.50 for 12 ounces → $0.37 per ounce

- Box B costs $5.50 for 16 ounces → $0.34 per ounce

Even though Box B looks more expensive at first glance, the unit price reveals it’s actually cheaper per ounce. Over time, those savings add up significantly.

2. Cost Per Use: Calculate It Out

Beyond groceries, consider how long a product will last you. A $60 pair of shoes that you wear 100 times comes out to $0.60 per wear, while a $30 pair that falls apart after 10 wears costs $3 per wear. Looking at cost per use helps you see the real value beyond the sticker price.

3. Discounts and Memberships: Use Them

Watch for stores that inflate “original prices” just to advertise big discounts. A jacket “marked down” from $200 to $120 sounds like a great deal—until you realize the store never sold it for $200. Check other retailers or online price trackers to see if the sale is genuine.

Final Thoughts

Pricing is as much about psychology as it is about math. Retailers use strategies like charm pricing, anchoring, decoys, “free” offers, and scarcity to influence how we see value and what we’re willing to pay.

But, when you step back and focus on unit price, cost per use, and genuine market comparisons, you regain control of the purchase. Real deals aren’t always the ones screaming for attention. They’re often the quiet, practical choices that consistently save you money and make life easier. By learning how pricing psychology works, you’ll not only shop smarter but also avoid falling for tricks that look like savings but really aren’t.

And that’s the kind of deal worth taking~